Government and Nonprofit Accounting: Concepts and Practices

Rajendrayasobhusanam

July 6, 2016Understanding Deposit Slips: The Importance of Properly Documenting Bank Deposits

August 14, 2020For example, if a city’s public works department exceeds its budget due to unforeseen infrastructure repairs, variance analysis would highlight this overage, prompting corrective actions such as reallocating funds or adjusting future spending plans. In particular,a discussion of GASB proposed changes to the governmental fund reporting modelis found beginning on page 5-33. Ongoing engagement mechanisms, such as public consultations, surveys, and advisory committees, allow stakeholders to voice concerns and contribute to decision-making. For instance, participatory budgeting initiatives invite citizens to directly influence public fund allocation, enhancing trust and transparency in government decisions. Liquidity ratios, such as the current ratio and quick ratio, evaluate short-term financial health, providing insights into the entity’s capacity to meet short-term obligations and maintain operational stability. Utilizing financial analysis tools like Tableau or Power BI enhances monitoring and visualization of these metrics, providing actionable insights for strategic decision-making.

Governmental and Nonprofit Accounting Essentials

Each chapter’s end of chapter content includes a case study featuring a real-world governmental accounting scenario that requires students to access reports and complete a series of requirements. Understanding the key concepts and practices within this field is essential for accountants, auditors, and administrators who handle public funds or manage charitable activities. Governmental entities typically classify funds into categories such as general, special revenue, debt service, capital projects, and permanent funds. Each serves a unique function, with general funds covering operational expenses and special revenue funds designated for specific projects.

Think Global Health

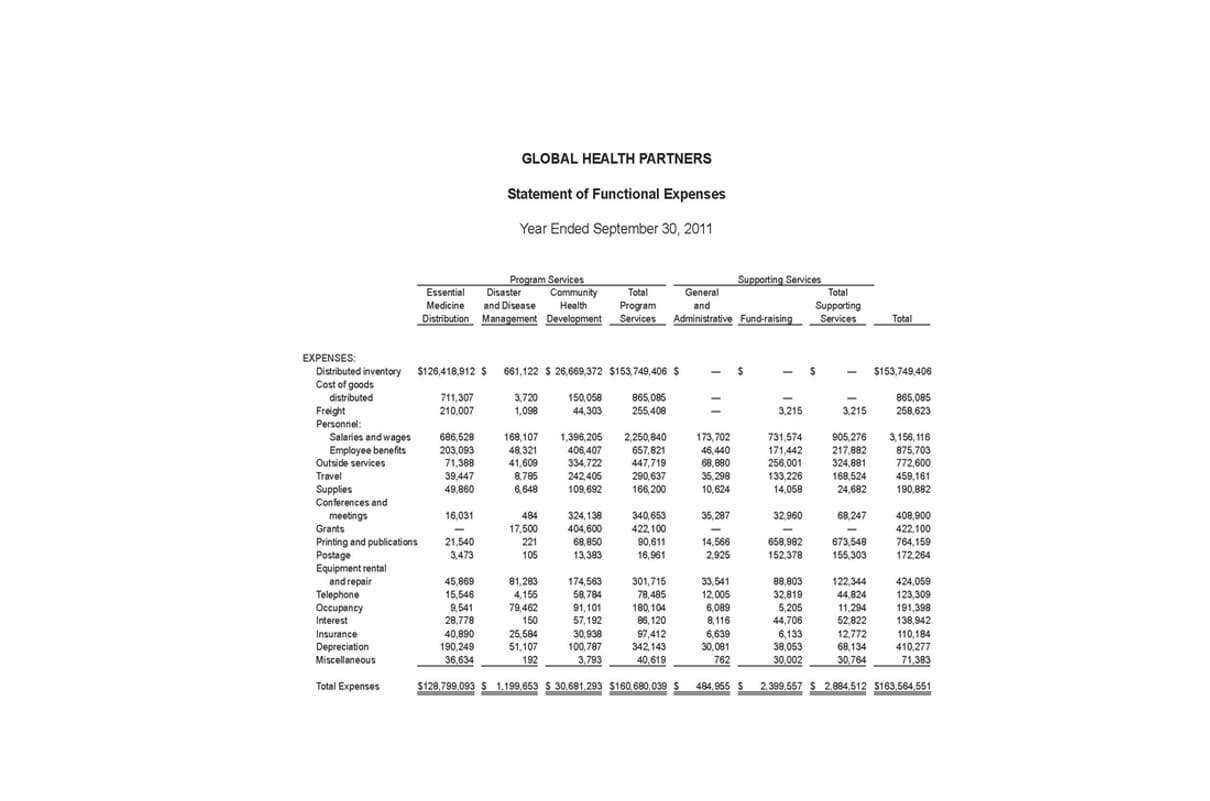

- Additionally, we will learn about the major components in the Statement of Financial Position.

- These methods help organizations assign indirect costs, such as administrative salaries or utilities, to the appropriate cost centers.

- It ensures that financial statements accurately reflect the organization’s financial position, enabling stakeholders to make informed decisions.

- Government entities, including state and local governments, are responsible for preparing various fund financial statements, along with government-wide statements, to report on the financial activities of governmental funds, proprietary funds, and fiduciary funds.

- GASB Statement No. 34 introduced government-wide financial statements, providing a comprehensive overview of a government’s financial position.

For example, separating responsibilities for authorization, record-keeping, and asset custody enhances accountability. Regular audits, whether internal or external, provide independent assessments, identifying areas for improvement. This functional tracking demonstrates nonprofits’ efficiency and effectiveness in using donor funds, maintaining donor trust and securing future funding.

Financial Performance Metrics

It involves segregating resources into various funds, each with its own set of accounts, to ensure proper use and accountability. Activity-based costing (ABC) attributes costs to specific activities based on resource consumption, offering a detailed understanding of cost drivers and identifying efficiency improvement areas. Implementing cost allocation software like Prophix or IBM Planning Analytics facilitates these processes, enabling accurate cost allocation and streamlined financial reporting. To achieve its strategic goals, the fund’s board should consist of four cabinet secretaries (ideally from Commerce, Energy, State, and the Treasury), two current members of Congress, and three independent directors.

Governments’ ability to invest via a wide array of financial instruments to achieve strategic goals has become a normalized, if not required, part of advanced economies’ economic and national security toolkit. While the United States has the most innovative financial system in the accounting for governmental and nonprofit organizations world, its inability to evolve how and when it harnesses its financial firepower has left the U.S. government racing to find ways to compete with its adversaries at home and abroad. The answer is a U.S. strategic investment fund with appropriate guard rails and an emphasis on placing long-term bets on new institutions that protect the United States’ economic centrality for the next fifty years.

Email Privacy Policy

You’re giving them money rather than investing with the hope of getting your money back plus a gain at a future date. Analyzing the financial statements of a nonbusiness organization shouldn’t be too much of a stretch if you’re at all familiar with the analysis of for-profit financial statements and if you understand what each statement is supposed to be. Fund accounting groups financial data together into funds or accounts that share a similar purpose. This gives the organization a better idea of what resources it has available to complete a specific task. Fund accounting typically isn’t a topic that’s enjoyed by people who are used to the concepts of for-profit accounting.

Donating money blindly without making sure that it’s getting to those who need it is the same. An investment in a nonprofit is treated the same as any other AI in Accounting type of investment, subject to capital gains on growth and profit. You can claim a tax deduction for contributions you make to qualified organizations, however.

- Fund accounting is central to financial management in government and nonprofit organizations, offering a structured approach to tracking resources.

- GAAP for nonprofits, as laid out by the FASB, ensures that financial statements of nonprofits accurately reflect their financial health and performance, providing stakeholders such as donors, grantors, and regulatory agencies with relevant and reliable information.

- It also loses the ability to receive tax-deductible gifts from donors who are eligible to make them.

- Explore the core principles and practices of accounting in governmental and nonprofit sectors, focusing on financial management and reporting.

- Periodic audits verify compliance and identify discrepancies or potential areas for improvement, helping nonprofits maintain the trust of funding partners and secure continued financial support.

- Governments and nonprofits often operate under strict budgetary constraints, necessitating rigorous monitoring of fund balances.

Financial Analysis for Nonprofits

They’ll often use specialized accounting software that’s designed to meet their financial reporting obligations. Governments and nonprofits take our tax and contribution money to provide valuable services. It’s important to understand the different financial statements for these nonbusiness organizations (NBOs) so you can be sure where your money is going. Many investors have some understanding of typical financial statements like the balance sheet, income statement and cash flow statement but governmental and nonprofit financial statements may be significantly less familiar. Financial analysis in the nonprofit sector involves evaluating the organization’s financial health and performance to inform strategic decision-making.

English Language Proficiency Requirements

These statements complement traditional fund-based reports by offering a broader perspective on fiscal health, ensuring stakeholders have access to a full spectrum of financial information for informed decision-making. Financial reporting and standards form a fundamental distinction between government and nonprofit accounting. Each sector operates under different governing bodies and fixed assets follows unique reporting requirements, impacting how financial statements are prepared and presented. At Capital Business Solutions, we specialize in nonprofit financial software consulting, helping organizations navigate generally accepted accounting principles (GAAP) for nonprofits with ease. Join us as we explore three major differences between government and nonprofit accounting, shedding light on the specific standards, practices, and principles that set them apart. Fund Financial Statements focus on individual funds within the governmental entity, crucial for understanding specific funds’ financial performance and position.